Introduction

What is a Market Portfolio? A market portfolio only experiences systematic risk, which impacts the market as a whole, and not unsystematic risk, which is unique to any asset class because of its high degree of diversity. Let's use a fictitious market portfolio example featuring Companies A, B, and C to demonstrate this idea. A company with a $2 billion market cap, B with a $5 billion market cap, and C with a $13 billion market cap. The market cap as a whole is $20 billion. The market portfolio includes each of these companies.

How Is The Market Portfolio Managed?

A market portfolio is diversified across various asset classes to maximise investment returns while limiting unsystematic risk. Building a portfolio and maintaining it over time while keeping track of market movements are two separate but connected processes.

To maximise returns while minimising risk, innovative portfolio management must be continuously monitored, and new techniques must be implemented. The results of careful portfolio management are as follows: Longer-lasting income is generated, and risks are reduced. Market and investment strategies can be used to rebalance the securities portfolio. Each investor's portfolio can be maintained in real-time and customised to meet their unique demands. Additionally, management prepares the path for investigating the assets that can produce additional returns.

What You Need To Know About Market Portfolios?

Because many indices will produce the same results, numerous schools of thought have been developed about the importance of the index in a market portfolio. Roll argued in support of his claim that it is essential to use the correct index, which he said in the previous sentence. He stated that the ability to impact ranks might be achieved by carefully selecting indexes. Brown & Brown, in this sphere, conducted the research. Several different indices were utilised to gauge the performance of stocks and bonds, stocks just, stocks and bonds plus real estate, and stocks alone. They concluded that the various real estate strategies had notably varied outcomes.

What Are The Types Of Market Portfolios?

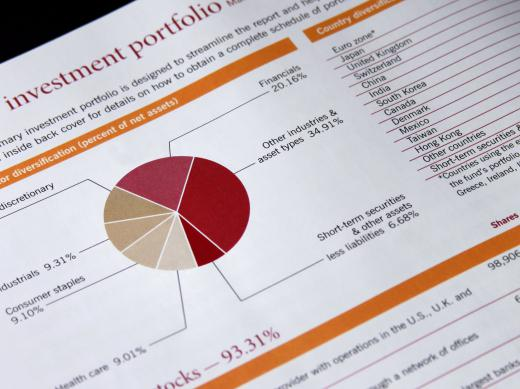

The portfolio is said to be defensive when the individual securities that make up a portfolio have low betas. The principal objective of a defensive investment strategy is to maintain the value of the investor's investment capital throughout the investment strategy. The stocks that make up an investment portfolio like this are selected because they have no connection to movements in the market. Investors typically opt for returns that are on the lower end because they want to limit their risk exposure.

If you are looking for the potential for more significant profits, you should have an aggressive portfolio that entails taking on more risk. Consequently, the beta is relatively high, and the volatility in stock prices is being used to generate profits. Investors in this predicament should keep a careful eye on their holdings to ensure they responsibly manage significant sums of money.

The accumulation of dividends is the primary goal of an income portfolio, which is a specific kind of investment account. The cash flow of an investment is often generated by the underlying companies in the form of interest or dividend payments. The effect that the state of the economy has on the assets and securities held within an income portfolio is the most readily apparent.

A speculative portfolio is the type of investment plan that carries the highest level of risk because of the enormous dangers associated with investing in an initial public offering (IPO) or based on market rumours. Investors who are willing to take significant risks typically utilise hypothetical portfolios. This investment strategy considers the likelihood that significant economic adjustments will occur soon due to advancements in technical or organizational systems.

It is anticipated that the value of investments held in the Growth portfolio will increase in the not-too-distant future as a direct result of decisions made either recently or in the past. The potential for profit in this portfolio is exceptionally high, even though a great deal of risk is involved. The securities that make up a value portfolio can be acquired at a lower price after some amount of negotiating. When the economy is in a slump, the value of these assets tends to fall precipitously, prompting investors to seek out alternative investments such as equity markets. After an economic uptick, this category of investments typically results in significant profits for those who hold them.

Conclusion

The market portfolio is a crucial component of the capital asset pricing model and needs to be carefully designed (CAPM). The CAPM shows an asset's predicted return, a well-liked asset pricing model, based on the asset's level of systematic risk. The security market line equation explains the relationship between these two variables.