-

Investment Aug 22, 2022 By Triston Martin

Investment Aug 22, 2022 By Triston MartinWhat Is FMRR (Financial Management Rate of Return)

The FMRR (Financial Management Rate of Return) shows how well an investment in real estate is doing. It is used to judge REITs. Because it is so hard to figure out how to calculate the financial management rate of return, many real estate professionals and investors prefer to use other metrics when analyzing real estate.

-

Investment Aug 22, 2022 By Triston Martin

Investment Aug 22, 2022 By Triston MartinBest Habits of Successful Real Estate Investors

When you have never done it before, investing in real estate can be scary. You might not know where to start, how much to invest, or what to look for in a property before you buy it. When it comes to investing in real estate and making money off of it, a degree is not necessary for everyone.

-

Investment Aug 22, 2022 By Triston Martin

Investment Aug 22, 2022 By Triston MartinAffordable Housing: Investing for Profit? Is It Good for You

Many real estate investors have affordable housing in their portfolios, mostly because this kind of housing comes with tax breaks from the government. There are several reasons why affordable housing could appeal to investors in multifamily real estate. These properties are in great demand, so many feel they are impervious to economic downturns.

-

Investment Aug 22, 2022 By Triston Martin

Investment Aug 22, 2022 By Triston MartinWhat Is a Sealed-Bid Auction? Is It Good For You

One type of auction is a sealed bid. If there are a lot of people who want to buy a property, the agent will ask them to send in a sealed bid. After that, the seller should pick the offer that is the most favorable to them. Because of the many factors involved, this is not necessarily going to be the highest offer.

-

Investment Aug 22, 2022 By Triston Martin

Investment Aug 22, 2022 By Triston MartinWhat Is a Blue Chip Stock? A Complete Review

Blue chip stocks are investments in large, well-known corporations that have established themselves as reliable. A lot of these businesses are well-known. However, there's no formal definition, "blue-chip stocks" are valued, steady, and well-known. Investors know they may put their faith in them most of the time since they are well-known in their respective area.

-

Investment Aug 22, 2022 By Triston Martin

Investment Aug 22, 2022 By Triston MartinWhat is a Fidelity Bond? A Complete Guide

Fidelity bonds shield corporations against employee misconduct. Most of the time, fidelity bonds are put in place to shield companies from the dishonest acts that may be committed by their personnel. In contrast to other types of bonds, Fidelity bonds neither accrue interest nor can they be exchanged publicly.

-

Investment Aug 22, 2022 By Triston Martin

Investment Aug 22, 2022 By Triston MartinWhat Is DEMAT (Dematerialization)? What You Need To Know

Dematerialization refers to the act of converting your physically held shares and securities into their corresponding digital or electronic versions. The primary objective is to make it less difficult to purchase, sell, transfer, and keep shares, as well as to reduce transaction costs and the likelihood that anything will go wrong.

-

Investment Aug 22, 2022 By Triston Martin

Investment Aug 22, 2022 By Triston MartinWhat Is an Effective Annual Interest Rate? Everything You Need To Know

The rate of interest that most truly depicts the return on an investment or loan is the effective annual interest rate. This rate of interest takes into account the effects of compounding and is calculated annually. Compounding that takes place more often results in a rise in the interest rate.

-

Investment Aug 22, 2022 By Triston Martin

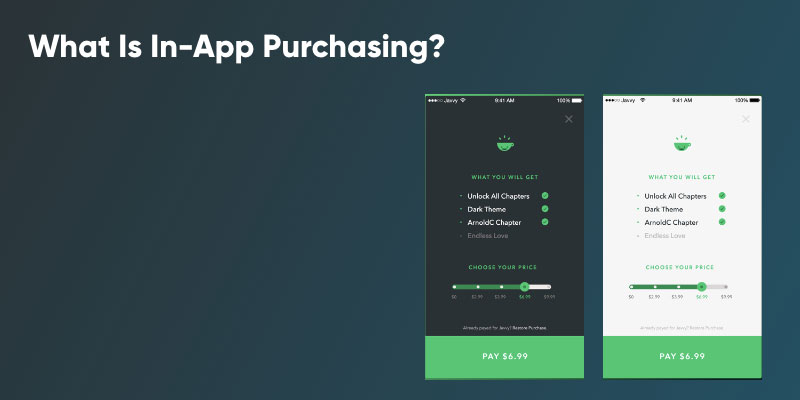

Investment Aug 22, 2022 By Triston MartinWhat Is In-App Purchasing? What You Need To Know

When you purchase products or services from inside an app on a mobile device like a tablet or smartphone, this is known as in-app buying. Since in-app purchases are made on mobile devices, they can be a security risk if made without permission. We'll talk more about In-App purchases in the next section.

-

Investment Aug 19, 2022 By Triston Martin

Investment Aug 19, 2022 By Triston MartinLearning How to Calculate the Percentage Gain or Loss on an Investment?

When there is a rise or decline in the value of an investment, the corresponding monetary amount needed to return it to its initial (starting) value is the same as the monetary value of the change. Still, the sign of the amount is changed to reflect the direction of the change. When represented as percentages, the gains will be more significant than the losses; nonetheless, the losses will still be greater than the gains. This is because the same dollar amount is expressed as a percentage of two different quantities, which results in this situation.

-

Investment Aug 19, 2022 By Triston Martin

Investment Aug 19, 2022 By Triston MartinWhat Is Extended Trading?: All You Need to Know

In contrast, extended trading takes place through electronic networks before and after the usual trading hours of the listed exchange. Usually, there is less trading activity during these hours than during regular trading hours.

-

Investment Aug 19, 2022 By Triston Martin

Investment Aug 19, 2022 By Triston MartinDo You Know: How Splitwise Makes Money?

You have access to Splitwise, a financial program that powers a web interface and a mobile app. Splitwise does not support cash transactions, so you cannot link it to a bank account. Splitwise does not enable cash transactions, but this booming industry offers clients options to enhance and automate their financial operations. Splitwise solely keeps track of a user's spending and personal debts as its two financial metrics.

-

Investment Aug 19, 2022 By Triston Martin

Investment Aug 19, 2022 By Triston MartinSee: How Venture Capitalists Make Investment Choices?

Venture capitalists (VCs) agree that an organization's personnel is a more critical factor in determining the success or failure of an investment than the organization itself. Venture capitalists prioritize all three aspects of the value creation process; the sourcing of deals; the selection of sales; adding value after an investment has been made.

-

Investment Aug 19, 2022 By Triston Martin

Investment Aug 19, 2022 By Triston MartinHow to Start Your Private Equity Fund?: A Complete Guide

Private equity funds have a history of outperforming the S and P 500 Index in recent years as a popular investment choice for institutional and high-net-worth investors. It's not surprising that private equity is gaining the interest of potential portfolio managers, given its track record.

-

Investment Aug 19, 2022 By Triston Martin

Investment Aug 19, 2022 By Triston MartinEverything You Need to Know: Market Value Of Equity

A company's market capitalization is equal to the aggregate market value of its shares. The present value of a company's shares, multiplied by their current price, determines its market capitalization.

-

Investment Aug 19, 2022 By Triston Martin

Investment Aug 19, 2022 By Triston MartinAn Eccentric Guide: What is a Market Portfolio?

A market portfolio is a fictitious investment portfolio equally weighted in the various asset classes available to investors. Therefore, the expected return for a market portfolio is equal to the market's overall return.

-

Investment Aug 19, 2022 By Triston Martin

Investment Aug 19, 2022 By Triston MartinAll About Equity Economic Value (EVE): What Is It?

The economic value of equity (EVE) is a cash flow formula that requires determining the present value of all cash flows from assets, then subtracting that value from all cash flows from liabilities. This leaves you with the net cash flows from assets, which is the economic value of equity. Financial institutions utilize the economic value of equity as a management tool for their assets and liabilities rather than the EATR or VAR.

-

Investment Aug 19, 2022 By Triston Martin

Investment Aug 19, 2022 By Triston MartinExplain: The Risks and Rewards of Investing in Startups

Putting money into a fledgling company is a venture fraught with peril, but the potential returns can be substantial if it is successful. There is a real chance of losing all of one's money, given that most businesses are unsuccessful. Those who are successful, however, can enjoy significant benefits due to their achievements.

-

Investment Aug 19, 2022 By Triston Martin

Investment Aug 19, 2022 By Triston MartinSee: How to Use a Moving Average to Buy Stocks?

A moving average can be calculated using a variety of techniques. The last five closing prices are added, then multiplied by five to create a five-day simple moving average (SMA). The continuous curve is created by connecting the standards.